A proposed mountain bike skills park in Queen Elizabeth Park created debate amongst recreational advocates and environmental voices, but City Council had the final say and approved the mountain bike park.

The Edmonton Mountain Bike Alliance (EMBA) led the efforts in getting the proposal approved, will help with design and construction, plus handle much of the ongoing maintenance. Construction is scheduled to begin later this year and be completed next year.

Eric Gormley of Edmonton River Valley Conservation Coalition raised concerns about a “nibbling away” of Edmonton’s river valley and is of the opinion that the river valley should be reserved for natural connection rather than active recreation.

Councillor Aaron Paquette thinks there should be a balance between environmental concerns and reality and said “The best way to not impact the environment is not to have a city, but we do have one.” If folks are to provide amenities to turn a place that has already been disrupted into something that can be useful, and then also mitigate some of the issues that exist there currently, it makes a lot of sense to me.”

Public safety remains a concern for users of Edmonton Transit services. Two City Councillors, Aaron Paquette of Ward Dene and Ashley Salvador of Ward Métis say they would like to see greater police presence on Edmonton Transit but the decision regarding that is left to Edmonton Police Service (EPS). EPS receives almost half a billion dollars per year and has 26 constables dedicated to transit.

Paquette says he has made his concerns known to pretty plain to the city manager, to the police chief, and to our administration and to the province. Salvador echoes Paquette in saying we can share feedback with the police commission but responsibility for operational decision making, allocation of resources, where the patrols go, lies with the chief and the service.

EPS spokesperson Brooke Timpson said transit-related calls are increasing overall and EPS’ “primary approach” is to work with social service agencies to “connect vulnerable community members to available resources.”

A motion by Ward tastawiyiniwak Councillor Karen Principe to have candidates pay for criminal record checks conducted by the Edmonton Police Service was voted down 11-2 with Councillor Jennifer Rice being the other support vote. Principe thought the checks would provide public peace of mind and didn’t anticipate the backlash her motion received. Candidates for Provincial MLAs and/or Federal MPs aren't required to automatically hand over such information.

Councillors Aaron Paquette and Erin Rutherford voiced their concerns with the motion and Mayor Sohi said political parties backing candidates in future elections will probably be vetting those candidates.

Criminal checks have become common for many positions so its understandable why the motion was brought forward.

One of the things that politicians and bureaucrats at all levels of government need to be constantly reminded of when planning how to best serve the needs of their jurisdictions ...taxpayers are the one and only source of money you have to work with. Reading about Edmonton's "fiscal gap" in the article below indicates that past and present mayors, councillors and bureaucrats have found it too easy to spend other peoples' (taxpayers) money and have overspent on questionable projects. With the lack of funds and inability to pay for the expenditures, they have in effect now saddled the citizens of Edmonton with the obligation to pay the debt through their taxes, which will probably be increased.

Other ways of servicing the current debt are being considered, and hopefully it doesn't override the greatest need, which is for the mayor, councillors and bureaucrats to be fiscally responsible and only budget what can be paid for without burdening taxpayers with increased taxes. The next civic election is about a year away and hopefully there will be a slate of candidates whose platform includes being fiscally responsible.

Let’s Talk About How Municipal Budgets Actually Work in Edmonton

By Aaron Paquette

Ward Dene

There’s a lot of talk about how Edmonton’s budget works, and it’s clear that many misconceptions exist. Some folks think the city is broke, while others believe we’re wasting money. So, let’s break it down with some facts about how the city manages its budget, where the challenges come from, and what we’re up against.

1. Edmonton Must Balance Its Budget Every Year

First, Edmonton cannot run a deficit—by law, our budget must be balanced each year. We’re not allowed to spend more than we earn. If we were actually “broke,” it would mean that services stop, and that’s clearly not happening. What we do have is a fiscal gap—this means that our revenue (money coming in) is not keeping up with our expenditure (money going out). The gap is widening due to factors both within and beyond our control. You can find more information about theCity’s Fiscal Reports here.

2. Financial Stabilization Reserve: The City’s Safety Net

Edmonton has a Financial Stabilization Reserve to protect against economic shocks. This reserve is a key financial tool, like a rainy-day fund, designed to help cover unexpected costs or shortfalls in revenue. But it’s not limitless—it needs to be carefully managed and used only in genuine emergencies. Drawing on these reserves is a strategy that helps the city maintain operations during downturns but doesn’t eliminate the need for other financial adjustments and strategies.

There are also other specific reserves, such as the Financial Services Reserve, which can be used for addressing short-term operational gaps or offering temporary tax relief. These reserves play a strategic role in stabilizing the city’s finances, but they cannot cover every gap we face. For further details, visit the City’sBudget Process and Financial Strategy.

3. Why Property Taxes Are Not Enough

A lot of people ask why we keep raising property taxes. The simple answer is that property taxes make up a huge part of Edmonton’s revenue—about 59% as of 2024, and we don’t have many other ways to generate income. Over the past two decades, property taxes have grown faster than any other revenue source because things like non-tax revenues (user fees, fines) haven’t kept pace with inflation and growing demands. More on this can be found in the Operating Budget.

Edmonton is expanding rapidly, but property tax revenue alone won’t keep up with the infrastructure and service demands. No city in Canada can survive or grow sustainably based solely on its local revenues.

4. Funding from Other Orders of Government: Differing Priorities

Edmonton depends on grants from the provincial and federal governments, which often come with specific conditions. While these funds are essential for projects the city couldn’t afford on its own, they often reflect the priorities of higher levels of government rather than Edmonton’s immediate needs.

This misalignment can be challenging. Turning down funding is rarely an option, even when it doesn’t match Edmonton’s top priorities. While the funds provide significant resources, they may not always address our most pressing local concerns.

For example, sometimes the city may receive targeted funding for specific projects, such as purchasing electric buses or other green initiatives, when local needs might focus on different areas like road maintenance or increasing public safety measures. These investments, though important for long-term sustainability, might not always reflect what residents or city council see as the most urgent need at that time.

This dynamic can lead to frustration when people see investments in areas they don’t feel are priorities. For instance, some residents may feel that funds are being wasted on public art or bike lanes, while others view these as essential investments in Edmonton’s future and identity. On the flip side, some people may prioritize policing, road expansions, or community safety measures, while others question whether those areas receive disproportionate focus at the expense of climate initiatives or public transit improvements. Differing priorities exist across the city, and balancing these needs is part of the city’s complex budgeting process. Read more about this in the City’s Budget Adjustments.

5. No City in Canada Can Survive on Just City Revenues

Here’s a fact not many people realize: no Canadian city, including Edmonton, can survive on municipal revenues alone. The property tax system simply wasn’t designed to fund cities dealing with rapid growth, complex social challenges, and the need for modern infrastructure. We’re expected to fill in the gaps left by higher orders of government, whether it’s in public health, social services, or even housing. You can learn more about Edmonton’s fiscal challenges in theCAPITAL AND OPERATING FUNDING SHORTFALL ANALYSIS.

6. Revenue Diversification and Strategies

Edmonton is working hard to diversify its revenue sources. While property taxes are the largest source, the city also collects user fees for services like transit, recreation facilities, and parking, as well as franchise fees from utilities like ATCO Gas and EPCOR. These revenues help reduce the reliance on property taxes, but they aren’t enough to fully offset growing expenses.

In addition, the city continually looks for efficiencies in operations, with a policy of identifying 2% efficiencies across every branch every year. This approach ensures that the city is constantly working to provide services more efficiently, but finding additional areas to cut without impacting essential services is becoming increasingly difficult.

7. How Does This Affect You, and What Can We Do About It?

Left unaddressed, the fiscal gap will lead to higher taxes, reduced services, or both. Infrastructure will deteriorate without enough funding to maintain or expand it. And remember, Edmonton can’t run a deficit, so we must find ways to bridge this gap every year.

But there are solutions on the table.

First, we need to diversify our revenue sources. Edmonton has been too reliant on property taxes for too long, and that’s not sustainable. We need to explore new ways to bring in non-tax revenues, such as expanding user fees where appropriate, growing our non-residential tax base, and finding ways to ensure that large, untaxed institutional properties contribute to the services they benefit from.

Second, we need strong advocacy for more predictable funding from higher orders of government. Long-term, stable infrastructure funding from the provincial and federal levels is crucial. If we can get solid commitments from these governments, we can better plan for the future instead of reacting to yearly changes in funding.

Third, I’ve developed a Municipal Fiscal Independence Strategy— what I’m calling The Money Plan. This is my plan to build greater financial autonomy for Edmonton. It focuses on growing revenue sources that are under direct municipal control, reducing our dependency on provincial and federal grants. The strategy includes actions like expanding municipal land sales, taking equity stakes in businesses that benefit from city grants, and leveraging assets like the EdTel Endowment Fund. By increasing our financial independence, we can make long-term investments in infrastructure, services, and economic development without being as vulnerable to the political shifts of other governments.

It will take a few different motions to fully develop The Money Plan, but I’m taking the first step this week by introducing a motion in committee. This motion will set the stage for further development, bringing us closer to a future where Edmonton can fund its growth and priorities more sustainably.

However, this work will require tough choices and conversations about what Edmontonians want to see in terms of service expectations, costs, and priorities. We also need to discuss how to right-size our operations and streamline city services. This means extracting Edmonton from areas like social services that rightfully fall under provincial jurisdiction. These decisions will have impacts, but the city simply can’t afford to continue operating in areas that strain our budget without sufficient funding.

If we address the fiscal gap head-on—with diverse revenues, strong government partnerships, and The Money Plan—Edmonton can continue to grow sustainably, without sacrificing the services and infrastructure that make our city a great place to live.

- Aaron Paquette's article first appeared in Reddit.

On Tuesday, City Council passed the 15 district policy, in a 10-2 vote. The policy still needs to be approved by the Edmonton Metropolitan Region Board before council can vote on the third reading to finalize the bylaw. Mayor Sohi attempted to paint a happy face ? on the public hearings that were held in May, but the undercurrent of mistrust runs deep and may turn that smile into a frown ?.

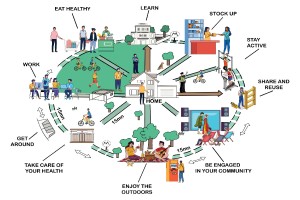

The City attempted to counter the concerns about the 15-minute cities concept but may have confirmed them instead with their doublespeak acknowledging that the city’s district planning program is meant to put the 15-minute city, into practice. The 15-minute city concept is intended to make it easier for people to find amenities closer to where they live and to move around with the option of using different modes of transportation. Concerns about restricting movement were so prevalent Councillor Aaron Paquette suggested the district policy be amended to clarify that this is not the intention. The amendment was unanimously approved by Council to say “The district policy and district plans shall not restrict freedom of movement, association, and commerce in accordance with the Canadian Charter of Rights and Freedoms.”